Business Financial Reporting for Entrepreneurs 3509588762

Business financial reporting serves as a fundamental tool for entrepreneurs, illuminating their company’s economic status and performance metrics. Accurate financial statements are not merely regulatory requirements; they are essential for strategic decision-making. They also play a pivotal role in fostering investor confidence and ensuring effective cash flow management. Understanding these elements can significantly impact a business’s trajectory. Yet, many entrepreneurs overlook critical aspects that could enhance their financial acumen and operational success.

Understanding Financial Statements

Financial statements serve as the fundamental tools for assessing a business’s economic health and performance.

Through statement analysis, entrepreneurs can evaluate financial ratios that reveal insights into profitability, liquidity, and solvency.

These metrics enable informed decision-making, guiding resource allocation and strategic planning.

Understanding financial statements empowers entrepreneurs to navigate challenges and seize opportunities, ultimately fostering a culture of financial independence and freedom.

The Importance of Accurate Financial Reporting

Accurate financial reporting is crucial for entrepreneurs, as it lays the foundation for sound decision-making and strategic planning.

Compliance requirements necessitate precise records, ensuring transparency and accountability.

By maintaining accurate reports, entrepreneurs can analyze performance effectively, identify opportunities, and mitigate risks.

This accuracy not only supports informed decision making but also fosters trust among stakeholders, ultimately enhancing the business’s potential for growth.

Attracting Investors Through Financial Transparency

When entrepreneurs prioritize transparency in their financial reporting, they enhance their appeal to potential investors.

This commitment to financial integrity fosters investor confidence, as stakeholders can assess the true health of the business without ambiguity.

Clear financial disclosures not only mitigate risks but also build trust, ultimately attracting more investment opportunities and promoting sustainable growth in an increasingly competitive market.

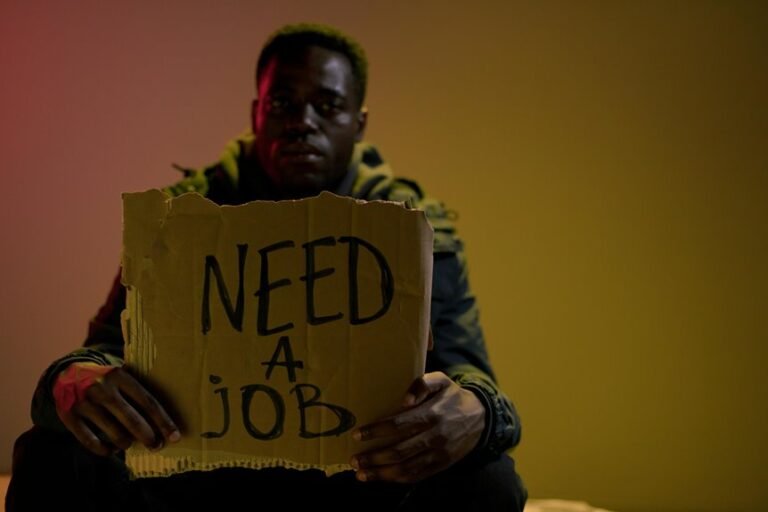

Managing Cash Flow With Effective Reporting

Effective cash flow management is crucial for entrepreneurs seeking to maintain operational stability and foster growth.

Implementing robust reporting techniques allows for real-time tracking of cash flow, enabling informed decision-making. By analyzing cash inflows and outflows, entrepreneurs can identify trends, anticipate shortfalls, and optimize resources.

This proactive approach not only enhances financial health but also empowers entrepreneurs to pursue opportunities with confidence.

Conclusion

In the intricate tapestry of entrepreneurship, financial reporting serves as the thread that weaves together clarity and strategy. By mastering the art of financial statements, entrepreneurs not only illuminate their company’s economic landscape but also cultivate trust among stakeholders and potential investors. With accurate reporting as their compass, they navigate the turbulent waters of cash flow management, steering towards sustainable growth. Ultimately, the ability to translate numbers into narratives is what transforms a business from mere survival to thriving success.